3 Critical Items You Must Know & Do Before Your NC Foreclosure Hearing!

Contact Us Immediately at 910-507-9744

At Campbell Home Solutions, we specialize in helping families stop and avoid foreclosure in North Carolina by guiding them through the entire process. With years of experience in the real estate business, we offer expert knowledge and effective solutions to assist homeowners facing various challenges, including foreclosures.

The COVID-19 pandemic has worsened the foreclosure crisis in North Carolina. Many families have experienced income loss or reduced work hours, leading to missed mortgage payments. Although temporary government relief was available, many have fallen significantly behind. This financial strain makes it increasingly hard for families to keep up with their loan obligations. As foreclosure proceedings rise, Campbell Home Solutions is here to help. Visit our website to see our success stories and contact us for support. Sometimes, a conversation can make all the difference. Remember, knowledge is power. Call or text us today at (910) 507-9744

Campbell Home Solutions – Your partner in avoiding foreclosure in North Carolina. Let us show you how to stop the foreclosure process in North Carolina, read our Stop Foreclosure page

Campbell Home Solutions is your local Foreclosure specialist. We are based out of Hampstead, NC, and service all of Southeastern NC, from Swansboro to Southport NC, including all 4 Coastal Counties of Brunswick, New Hanover, Pender, and Onslow.

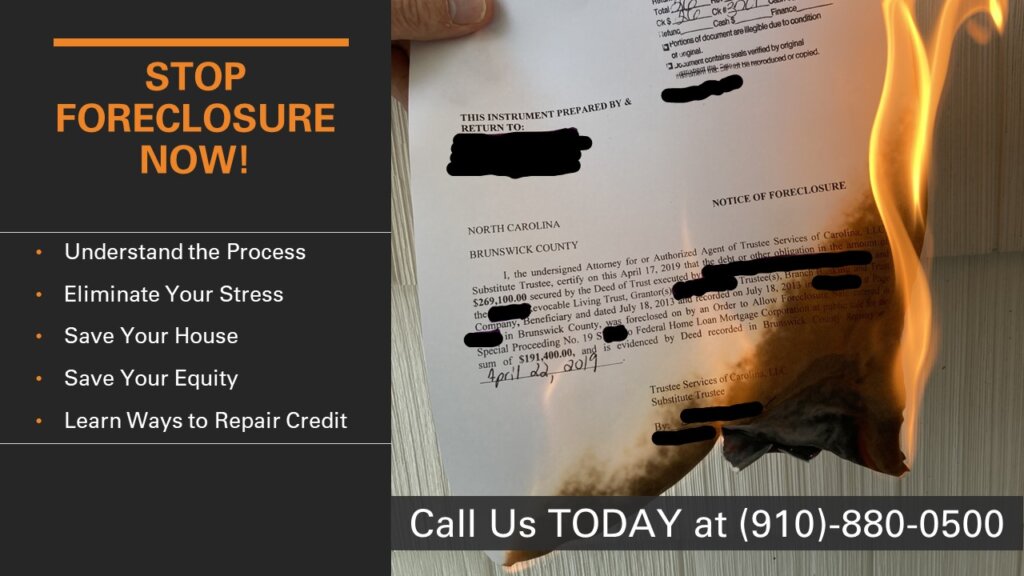

Stop and Avoid Foreclosure in Southeastern North Carolina, and Surrounding Areas!

The Foreclosure Process in North Carolina is lightning-fast compared to most states! Immediate action is necessary to save your house, equity, and credit.

When facing the risk of foreclosure, there are several options available to help you navigate through this challenging time. Solutions like Forbearance, Repayment Plans, or Loan Modifications can provide relief and prevent foreclosure proceedings. Read our page “Foreclosure solutions you should know” Lenders are typically willing to work with borrowers who have addressed the root cause of their financial difficulties. If your financial setback was temporary, and you have since stabilized your income, maintained timely payments on other obligations, and are now in a stronger financial position, there is a good chance of reaching a favorable resolution with the bank.

If we can be of service to you in your present situation, please give us a call at 910-507-9744 It may be that we can help you by simply giving you a free consultation over the telephone.

Remember, There are 2 Priorties in every Forclosure.

First Priority is to save your house, if that’s what you choose.

Second Priorty is to save as much equity as possibile, before you loose it at the foreclosure sale.

We speciize in both priorties, reach out to us before it is late 910-507-9744

Avoiding Foreclosure Sucess Stories

Success Stories: Homeowners saved their equity, credit and avoided foreclosure.

Turning a Bad Situation into Success: A Hampstead Homeowner’s Journey

A Homeowner in Hampstead NC reached out to us in a dire situation. COVID-19 had severely reduced his work hours, causing him to fall behind on mortgage payments. Despite his efforts, the bank refused to help, and he received a foreclosure summons. Even after attending the hearing, a sale date was set.

In desperation, he paid an attorney $1,500 to file for bankruptcy, hoping to stop the foreclosure. Instead, the court’s plan increased his monthly payments by $400 and added $3,500 in attorney’s fees. Unable to keep up, the foreclosure was reinstated.

Three weeks before the foreclosure sale, he contacted us. We stepped in and paid $35,000 to reinstate the loan and cover all outstanding Taxes and HOA dues, stopping the foreclosure. We then renovated his house, sold it, and covered all expenses, and he walked away with a significant amount to start over. Thanks to our intervention, he avoided foreclosure and is now financially stable and stress-free.

Let us turn your desperation into success. Contact us today. 910-507-9744

Saving a Home, Securing a Future: How We Helped a Homeowner in Financial Distress and Avoid Foreclosure

An older gentleman contacted us about his townhouse in Leland, NC. He was in financial trouble with the loan on his townhouse. The HOA had already filed for foreclosure due to delinquent dues and was granted permission by the court to set a sale date for his property. The lender also had a foreclosure hearing and scheduled a foreclosure sale date.

After meeting with the homeowner and explaining in detail how to avoid foreclosure, he signed an authorization for us to begin negotiating with the bank and attorneys to resolve his situation. With the bank on board and us writing a $33,000 check to cover all the delinquencies, we stopped the foreclosure actions from both the HOA and the bank. Since the homeowner didn’t have the credit or sufficient income to pay everything back, we completely updated and sold the house to get him the money he needed to move closer to his family.

We helped him find an affordable place to live, covered his mortgage payments, updated his townhouse, and sold it to secure the funds he needed for a stable future. We saved his equity, prevented a foreclosure from appearing on his record, and made life enjoyable for him again.

Call today to see how we can help you too! 910-507-9744.

Success Story: Helping a homeowner in Holly Ridge, NC keep his home.

Recently, we had the opportunity to assist a homeowner in Holly Ridge, NC, who was facing the possibility of losing his home. Due to a career change, he had fallen approximately $15,000 behind on his mortgage payments. He contacted us to explore his options and understand the best course of action to secure his home.

After signing authorizations allowing us to communicate with his bank, we began discussions to determine if there were any flexible programs or solutions available. The homeowner diligently gathered all necessary financial documentation to present a clear picture of his current situation. Fortunately, his income had stabilized, reaching a level that allowed him to manage his bills once more.

With the homeowner’s improved financial standing, the bank agreed to a favorable solution. They decided to defer the outstanding balance, placing it at the back of his loan at 0% interest. The only additional cost was for the preparation of the necessary documents. Once these documents were signed and recorded, the homeowner successfully retained his house.

This case highlights the importance of timely intervention and clear communication with financial institutions. We’re proud to have played a role in helping this homeowner secure his future and maintain his home.

Give us a call to discuss all your options at 910-507-9744

Success Story: Helping an Out-of-State Homeowner with a Problem Tenant

A former military serviceman stationed at Camp Lejeune purchased a property in Jacksonville off Old 30 Road in Jacksonville, NC. After residing there for around 3.5 years, he was reassigned to Florida for the remainder of his service. Opting to make Florida his permanent home, he engaged a property management company to oversee his Jacksonville property. Regrettably, the property suffered from mismanagement, a common occurrence in the real estate industry.

The renters were destroying the property by smoking inside, causing extensive pet damage, and the house became flea-infested. Additionally, the renters were not paying their rent. The property owner was in a difficult situation, and that’s when we stepped in to help.

We discussed the situation with the homeowner and knew we could provide assistance. We agreed to pay the mortgage to prevent the house from going into foreclosure. Next, we legally had the tenants removed through eviction proceedings. Once the house was vacant, we renovated and updated the property to make it market-ready. Lastly, we marketed the house for sale, found a buyer, and successfully sold the home.

Conclusion:

By stepping in and addressing the issues promptly, we saved the homeowner’s equity in the property. The successful sale not only prevented foreclosure but also allowed the homeowner to receive a sizable check at closing. This outcome ensured financial stability and peace of mind for the homeowner, proving that even the most challenging situations can be turned around with the right support and intervention.

Let us help you call us today 910-507-9744.

Helping a Seller Get Back on Track

We spoke with a seller in Jacksonville, NC, who had fallen behind on her house payments. She reached out to us early in the process when she was three payments behind and about to miss a fourth. We reviewed all her available options. She had the ability to make up one payment, but the bank required her to go through the loss mitigation department and complete their paperwork before they would consider working with her, which she found challenging. Her income was just enough to cover her bills, but with her recent increase in work hours, she would be able to manage moving forward. She just needed a break.

We discussed the possibility of seeking help from her family. With our assistance, she secured a small loan from her family, and we devised a payment plan that mostly relied on an upcoming tax refund. I coordinated with the bank to get all the payments settled and the loan reinstated. She just needed someone to guide her through the process to resolve the situation.

By weighing all her options and acting quickly, we were able to stop the foreclosure early. Working together, we helped the seller in Jacksonville, NC manage her financial troubles. With a small loan from her family and an upcoming tax refund, we created a workable payment plan. Coordinating with the bank, we ensured all her payments were made and her loan was reinstated. This experience demonstrates how timely help and guidance can solve financial problems and bring peace of mind.

Call or text us today to discuss your situation at 910-507-9477.

We have helped families Avoid and Stop Foreclosure in Brunswick, New Hanover, Pender, and Onslow Counties in North Carolina. The laws are the same in all counties in NC so if you have questions please reach out. Call or Text (910) 507-9744.

If you live in the Jacksonville area including Richlands, Maysville, Midway Park, Hubert, and Swansboro NC visit our sister website JacksonvilleSold.com

Causes of Financial Stress

Financial stress can arise from various situations, leading to missed payments. Here are some common causes:

- Death of a Loved One: When a family member passes away, the family may struggle to keep up with monthly payments while the estate is being settled, which can take several months, resulting in missed payments.

- Job Loss: Losing a job creates financial hardship, making it difficult to meet payment obligations.

- Divorce: Supporting two separate households can strain finances, leading to missed payments.

- Extensive Repairs: Major repairs, such as fixing a broken HVAC system, can cause a financial downturn.

- Health Issues: Medical problems can lead to significant expenses, contributing to financial stress and missed payments.

Campbell Home Solutions has helped many families through difficult times to keep their homes. If you are struggling to stay ahead of your bills, call us at 910-507-9744. Let’s find a solution before it’s too late.